This example shows the proper method of preparing an entry under HTS 9005.90.8000 (and other similar provisions) where the duty rate is the rate applicable to the article of which it is a part or accessory.

In this example the merchandise is an accessory for an optical telescope.

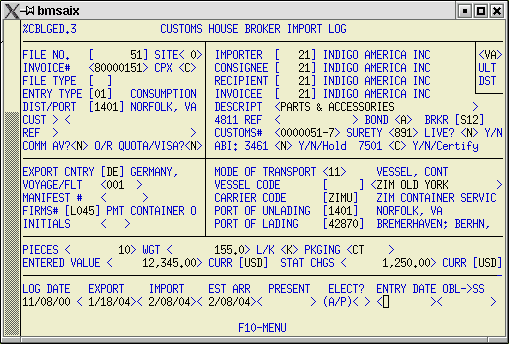

1) Log the file as usual.

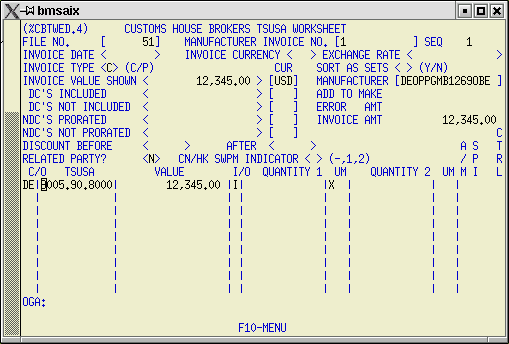

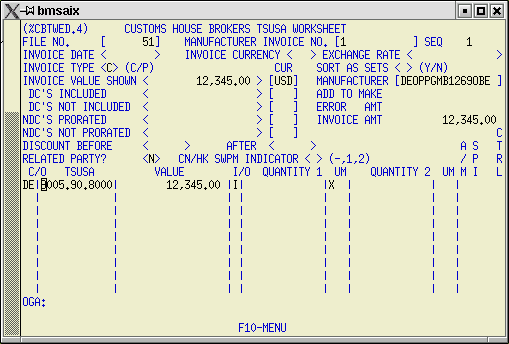

2) Go to the worksheet.

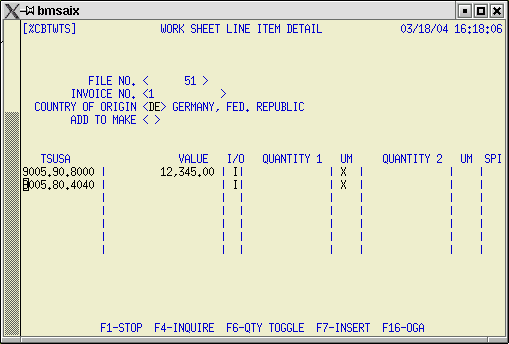

Enter the HTS number for the part/accessory (9005.90.8000), the value, and any net quantities required.;

When you press enter, you will be asked if a secondary HTS number is required. Answer 'N', then place the cursor on the sets classification line then press F8 to open the worksheet line item detail screen.

3) Enter the HTS data for the item that the product is a part/accessory of. Press Enter, then F1 to return to the main worksheet screen.

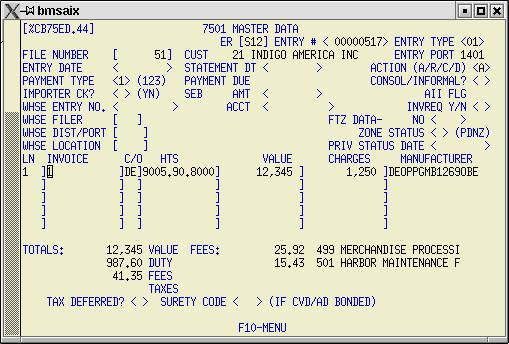

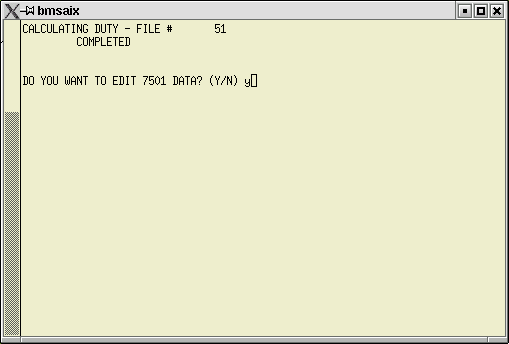

4) Use F7 to calculate the file. Answer 'Y' to review the 7501 prior to upload.

5) No changes should be required. Use ShftF4 to upload.