This example shows the proper method of preparing a sets entry under HTS 8206.00.0000 (and other similar provisions) where the duty for the entire set is determined by the article in the set with the highest duty rate.

In this example the set is a “Homeowners Toolkit”, consisting of a hammer, screwdriver, slipjoint pliers, and an adjustable wrench. The duty rate for the entire set is determined by the article in the set subject to the highest rate of duty.

For this example $12345 is the value of the entire set.

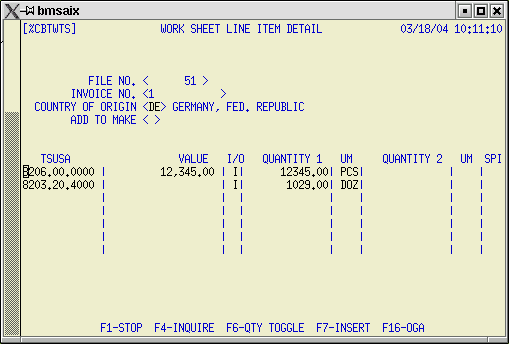

The pliers carry the highest rate of duty, therefore HTS number 8203.20.4000 is used as the secondary HTS that is used for duty calculations.

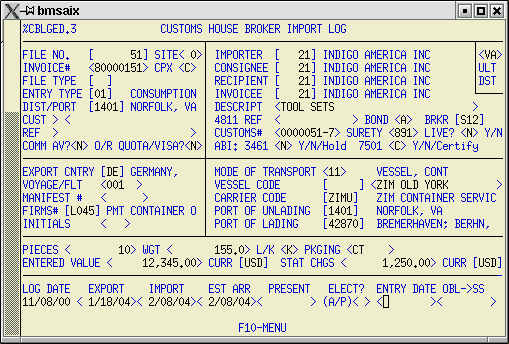

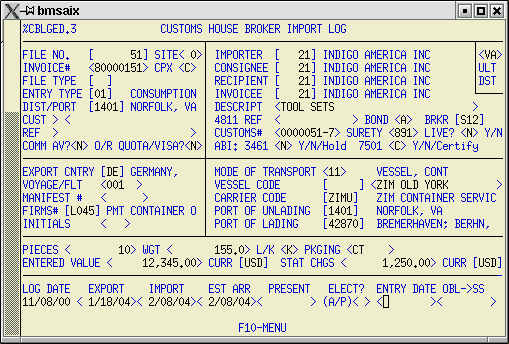

1) Log the file as usual.

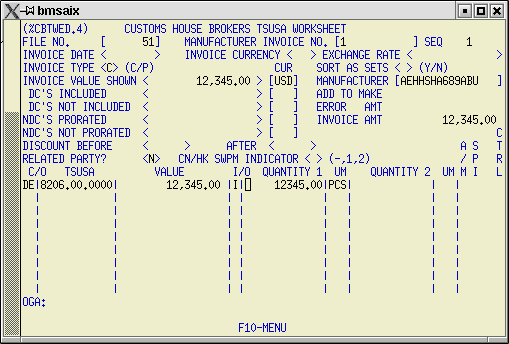

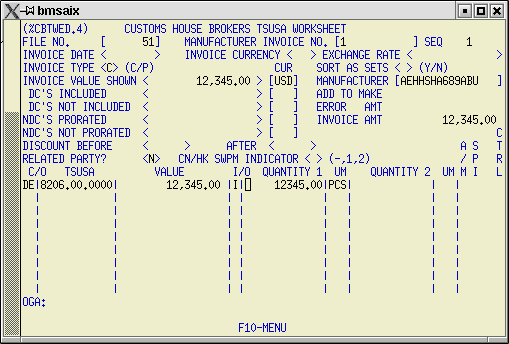

2) Go to the worksheet.

Enter the HTS number for the set (8206.00.0000), the value of the entire set, and the total aggregate number of pieces in the set.

When you press enter, you will be asked if a secondary HTS number is required. Answer 'N', then place the cursor on the sets classification line then press F8 to open the worksheet line item detail screen.

3) Enter the HTS data for the item in the set that determines the duty. Press Enter, then F1 to return to the main worksheet screen.

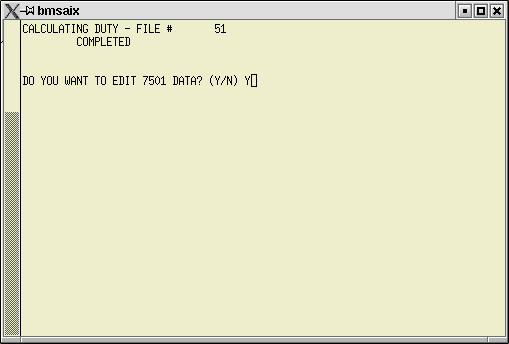

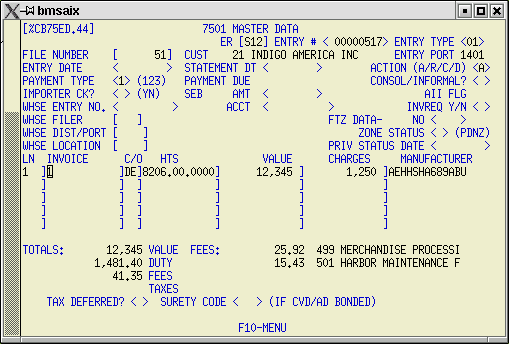

4) Use F7 to calculate the file. Answer 'Y' to review the 7501 prior to upload.

5) No changes should be required. Use ShftF4 to upload.

Notes: If a component of the set has a compound duty rate, you will need to use the advalorem equivalent rate to figure the duty. See knives